- #Quickbooks for mac credit card processing manual

- #Quickbooks for mac credit card processing full

- #Quickbooks for mac credit card processing pro

- #Quickbooks for mac credit card processing software

- #Quickbooks for mac credit card processing download

Simply return the product to Intuit with a dated receipt within 60 days for a full refund of the purchase price.ĥ. If you are not completely satisfied with your purchase, we'll give you your money back. Online services vary by participating financial institutions or other parties and may be subject to application approval, additional terms, conditions and fees.Ĥ.

#Quickbooks for mac credit card processing pro

This date does not apply to Pro Plus, Premier Plus or Enterprise customers.

#Quickbooks for mac credit card processing download

Pro and Premier customers may download data from participating banks until May 2024. Requires internet access sold separately.ģ.

#Quickbooks for mac credit card processing manual

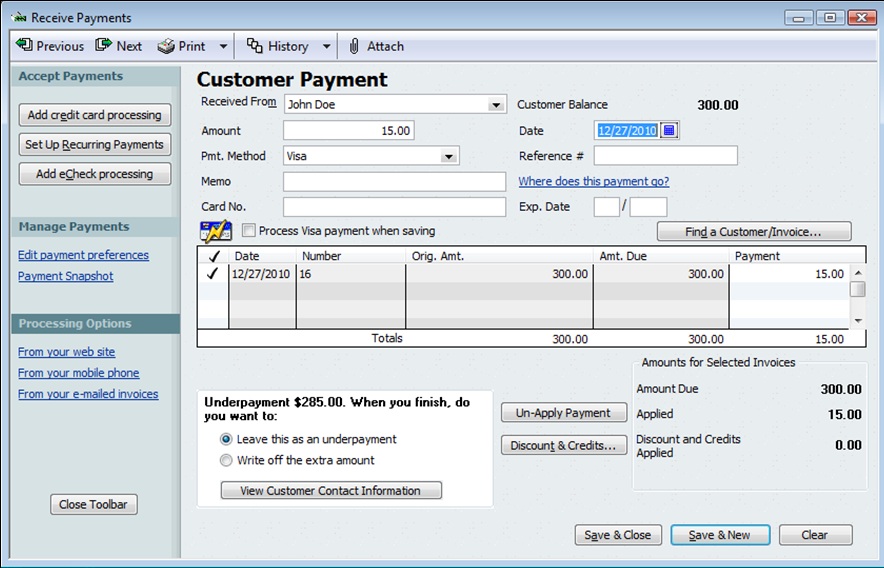

Online invoicing versus traditional or manual payment alternative. It’s unclear if Intuit has approved Verosa’s plugin officially. Use this QuickBooks point of sale device for customer card processing.

#Quickbooks for mac credit card processing software

The software is easy to use, and is designed for QuickBooks-using merchants seeking alternative processing avenues rather than have their credit card processing accounts with QuickBooks/Intuit. You can request the free mobile card reader from a link in your QuickBooks Payments approval email. E-file and e-pay features are available for federal and select state taxes. Verosa’s payment terminals allow customers to swipe cards via most USB card readers. 24/7 access is subject to occasional downtime due to systems and servers maintenance. However, performance may slow when processing files containing more than 250 employees. If your business has customers present to make a payment, then a simple. It is guaranteed compatibility for automated integration within QuickBooks, so no longer is the need to ever use old outdated, unreliable, standalone credit card terminals. QuickBooks Desktop Pro supports a maximum of 14,500 employees, customers, vendors and other names combined. Our QuickBooks online credit card processing is easy to use and is up and running within minutes. Easily add more for a nominal monthly fee. Not compatible with QuickBooks Online and Mac editions. Disclaimer: QuickBooks Payroll Enhanced requires a payroll subscription, Internet access, Federal Employer Identification Number (FEIN), supported version of QuickBooks Desktop Pro updated to the most current maintenance release, and valid debit/credit card on file for processing payroll.The accounts payable solution helps you streamline the bill payment process, routing bills in your company through the cloud for approval from anytime, anywhere, and paying your bills electronically to avoid signing, stamping, and addressing stacks of checks and envelopes.QuickBooks Desktop Premier Plus 2021 with Enhanced Payroll (1 Year Subscription) With the accounts receivable automation solution, you can create recurring invoices, automate payment reminders and overdue notices, support direct debit of customers' accounts, and more to help you get paid on time. Other FeaturesĪlong with offering a payment gateway to accept domestic ACH, international wires in USD or local currency, virtual card, or check, also provides businesses with additional efficiency by automating your accounts payable and accounts receivable processes. Find out more about how can be a great credit card alternative. For ACH payment processing, the same invoice would only cost $0.49. For example, a typical $10,000 payment may have a credit card process fee of $300. With, your business can accept ACH payments for a fraction of the cost of a credit card payment. While offers companies to easily accept credit cards, it’s main benefit is to replace credit card payments with even lower cost ACH payments. Or, Eliminate Credit Card Fees Altogether Data in transit is encrypted with Transport Layer Security (TLS). The entire audit trail can be accessed with a single click. allows users unlimited storage in the secure cloud, and every invoice that is paid has the relevant documents attached. Businesses typically have invoices, contracts, and other supporting documents that need to be referenced to ensure payments are recorded correctly. One of the roadblocks that prevent businesses from using electronic payments is the need for remittance information. However, by using, your business can take advantage of level 3 processing rates for all credit card payments, which decreases the typical fees associated with accepting credit cards. Typically, a small business may not qualify for the most competitive credit card processing rate because of their size. With, those obstacles are lifted, and you can now offer the convenience of accepting credit cards to get paid faster. However, because of various factors, businesses typically still use paper checks to pay other businesses. Business to consumer companies leverage credit cards on a daily basis to get paid easier.

0 kommentar(er)

0 kommentar(er)